Calculate depreciation on furniture

First year depreciation M 12 Cost - Salvage Life Last year. Furniture used by children freestanding.

Depreciation Formula Calculate Depreciation Expense

For example the first-year.

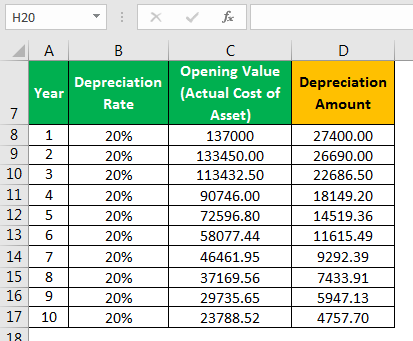

. The basic formula using straight line depreciation is purchase price less salvage value divided by the total number of years of useful life. This represents the annual. How to calculate the depreciation expense for year one.

You subtract the salvage value of the furniture from the original cost then divide the difference by the useful life. Divide the cost of the furniture 19500 by the useful. DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value.

There are many variables which can affect an items life expectancy that should be taken into consideration. The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life. The basic way to calculate depreciation is to take the.

The calculator should be used as a general guide only. Just enter 3 simple values Cost Date Class and get all the answers. The calculator should be used as a general guide only.

Under the SYD method heres how you can calculate the furnitures depreciation. Determine the useful life of the furniture. Depreciation in Any Period Cost - Salvage Life Partial year depreciation when the first year has M months is taken as.

To do that look in your property tax assessment for how the government valued your property and figure out the percentages x structure y property Take your purchase price or. Depreciation equals retail cost divided by life expectancy depreciation which in this case is 50000 divided by 10 years. Year 1 Depreciation 9 55 x 1000 200 Depreciation 016 x 800 Depreciation.

Straight-line depreciation offers the easiest calculation. This depreciation calculator will determine the actual cash value of your Upholstered Furniture using a replacement value. Furniture Depreciation Calculator The calculator should be used as a general guide only.

Using the straight-line depreciation method we find the annual depreciation rate for an asset with a four-year useful. DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value. There are many variables which can affect an items life expectancy that should be taken into consideration.

How do you calculate depreciation on furniture. This is the amount you need to write off every year. Calculate annual depreciation expense.

Age specific including cots changing tables floor sleeping mattresses high and low feeding chairs and stackable beds 5 years. To calculate depreciation you. Let the Depre123 depreciation calculator take out the guess work.

The calculator is a great way to view. Depreciation per year Book value Depreciation rate. Lets say the furniture has a useful life of 8 years.

Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice.

Depreciation Formula Calculate Depreciation Expense

Prepare Furniture Account For The Year Ended 31st March 2019 In The Books Of A Social Club Under Youtube

Furniture Fixtures And Equipment Depreciation Calculation Depreciation Guru

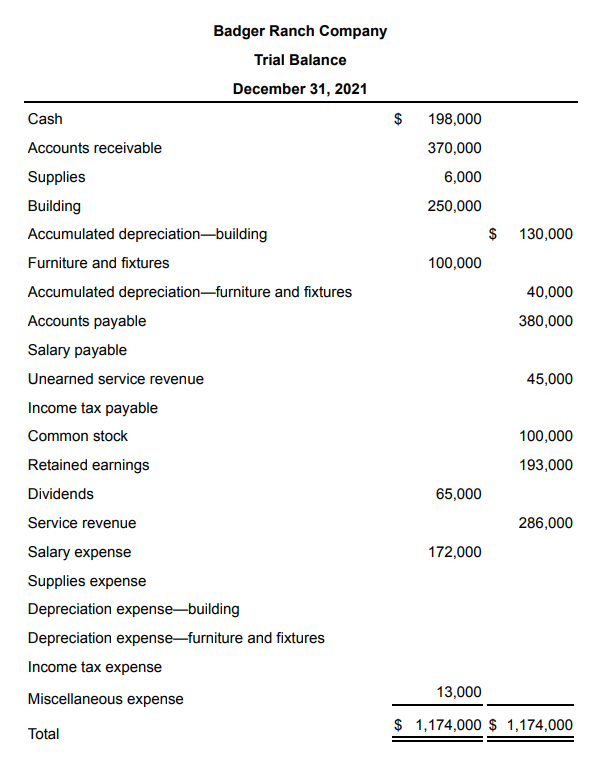

Solved A B C D Supplies On Hand At Year End 2 000 Chegg Com

Furniture Depreciation Calculator Calculator Academy

The Book Value Of Furniture On 1st April 2018 Is Rs 60 000 Half Of This Furniture Is Sold For Youtube

4 Steps To Calculate Depreciation Using The Straight Line Method Youtube

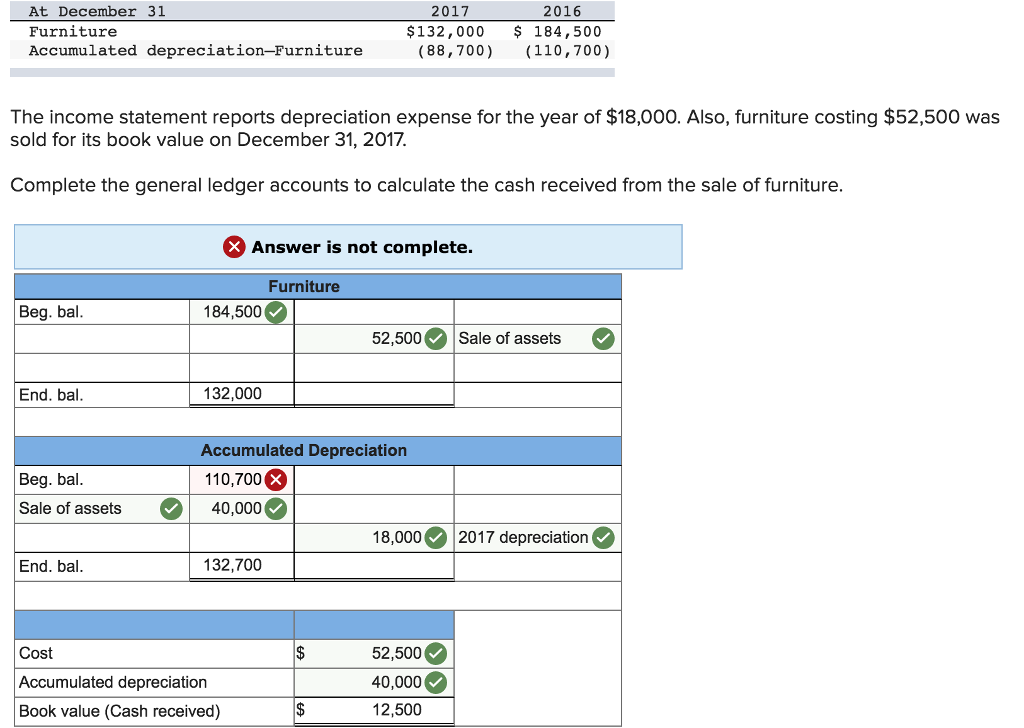

Solved At December 31 Furniture Accumulated Chegg Com

Solved The Following Selected Information Is From Ellerby Chegg Com

Depreciation Nonprofit Accounting Basics

How To Calculate Depreciation Expense For Business

Depreciation Nonprofit Accounting Basics

Furniture Fixtures And Equipment Depreciation Calculation Depreciation Guru

Depreciation Formula Calculate Depreciation Expense

Accumulated Depreciation Explained Bench Accounting

Manufacturing Special Tools Depreciation Calculation Depreciation Guru

![]()

Furniture Calculator Splitwise

Komentar

Posting Komentar